Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Proactive Solutions for Industry Challenges

Your Path to Financial Success

Our philosophy is the belief that property ownership should not be a challenging endeavor. We are committed to helping you achieve your business, financial, and personal objectives through our trusted partners.

We are collaborating to build an inclusive marketplace that empowers you with the resources to achieve future ownership, while fostering an uplifting environment.

EQWIT has established a reputation for providing fast and efficient services. This trust has been earned through consistently delivering on promises and meeting or exceeding customer expectations. As a result, many people have come to rely on our services when they require timely assistance. Building trust with our customers is an essential part of our company. We will connect you with our trusted partners to provide you with the services highlighted below:

We are collaborating to build an inclusive marketplace that empowers you with the resources to achieve future ownership, while fostering an uplifting environment.

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

We aim to empower you with the knowledge needed to make informed investment decisions and navigate the world of private equity with confidence.

Private equity investors can include institutional investors like pension funds, endowments, and wealthy individuals, along with accredited investors.

Private equity is a financing option where funds and investors invest directly in companies or in the buyouts of these companies, as an alternative to public markets. Compared to other forms of capital from private investors or firms, private equity is more easily accessible. Private equity can be beneficial for both startups and established companies, as it offers a way to leverage their potential through unconventional financing. By partnering with private equity firms, businesses can benefit from their expertise and guidance to achieve their goals, leverage their connections to identify opportunities for growth, and generate returns on investment.

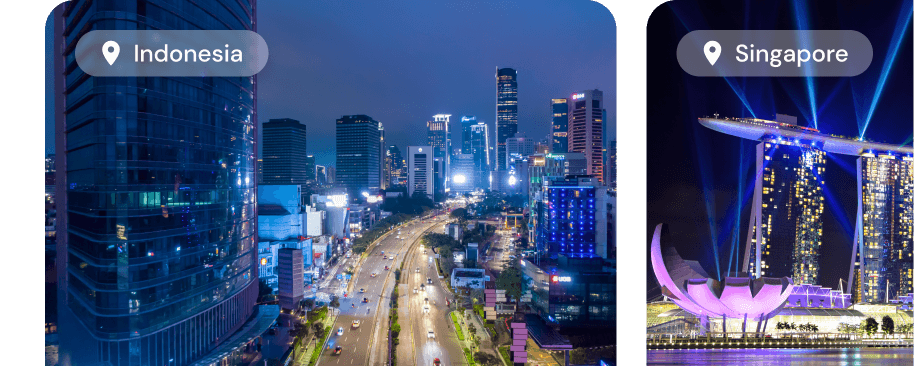

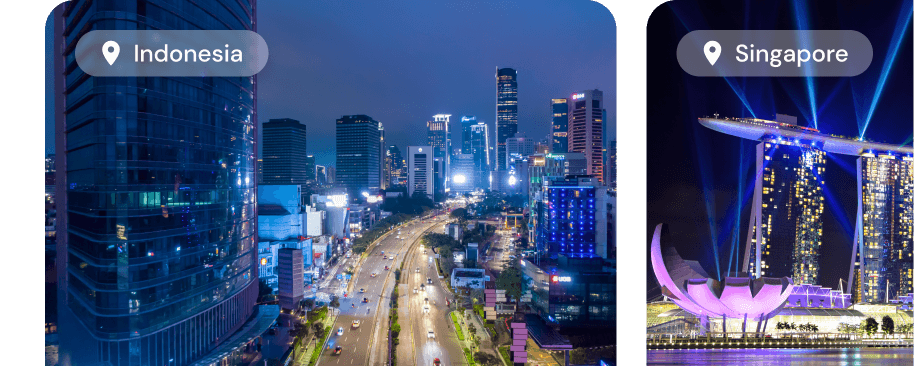

Direct investment Advisory refers to an investor or company buying a stake or complete ownership of a foreign company, with the aim of expanding the business to new regions and improving its operations and products. This can involve sourcing new materials, expanding the company's footprint, or establishing an international presence. To engage in direct investment advisory (FDI), it's important to target companies in open economies with a skilled workforce and strong potential for growth. FDI provides the investor with significant control over the foreign company's decision-making and direction.